Can a Lady Bird Deed Be Contested? A Comprehensive Guide to Protecting Your Inheritance

In the world of estate planning, few tools are as popular—or as misunderstood—as the Lady Bird Deed. Officially known as an “Enhanced Life Estate Deed,” this legal document is often hailed as a magic bullet for avoiding probate, protecting assets from Medicaid recovery, and ensuring a smooth transfer of property to heirs. It allows a…

In the world of estate planning, few tools are as popular—or as misunderstood—as the Lady Bird Deed. Officially known as an “Enhanced Life Estate Deed,” this legal document is often hailed as a magic bullet for avoiding probate, protecting assets from Medicaid recovery, and ensuring a smooth transfer of property to heirs. It allows a property owner to pass their home to beneficiaries automatically upon death, without the time and expense of court interference.

However, with the rise in popularity of these deeds comes a rising tide of litigation. Heirs often assume that once a deed is signed and recorded, it is set in stone. This is a dangerous misconception.

The short answer is: Yes, a Lady Bird Deed can be contested. Just like a Last Will and Testament or a Trust, a Lady Bird Deed is a legal instrument that can be challenged in court if there is evidence of foul play, legal error, or incapacity.

This guide explores the specific grounds upon which these deeds can be overturned, the legal vulnerabilities inherent in them, and what you can do—whether you are a grantor trying to protect your wishes or an heir suspecting foul play—to navigate this complex legal landscape.

1. What Exactly is a Lady Bird Deed?

To understand how a Lady Bird Deed is contested, one must first understand how it functions differently from a standard deed.

A standard “Life Estate Deed” transfers ownership to a beneficiary (the “remainderman”) immediately but reserves the right for the original owner (the “life tenant”) to live there until death. The catch with a standard deed is that the original owner loses control; they cannot sell or mortgage the property without the beneficiary’s permission.

The Lady Bird Deed (Enhanced Life Estate Deed) changes the rules. It works primarily in Florida, Texas, Michigan, Vermont, and West Virginia. It allows the original owner to:

- Retain the right to live in the property.

- Retain the right to sell, mortgage, or give away the property at any time without the beneficiary’s permission.

- Transfer the property automatically upon death, avoiding probate.

It is this second point—the “reserved power” to change one’s mind—that often becomes the center of legal battles.

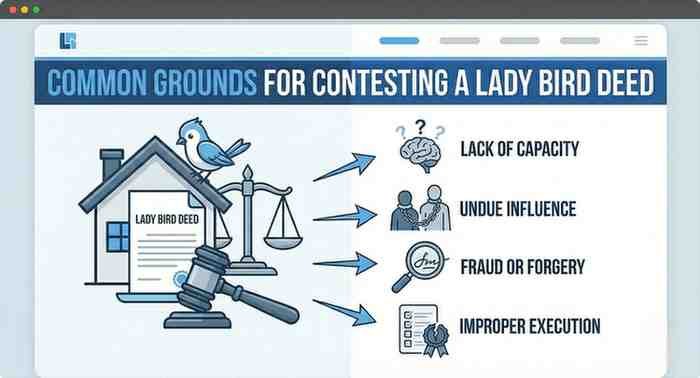

2. Common Grounds for Contesting a Lady Bird Deed

Challenging a deed is generally harder than challenging a Will, but it is far from impossible. Because a Lady Bird Deed is executed while the person is alive (unlike a Will, which takes effect after death), the challenger often has to prove that something went wrong at the specific moment of signing.

Here are the most common legal grounds used to contest these deeds:

A. Lack of Mental Capacity

This is the most frequent allegation in estate litigation. For a Lady Bird Deed to be valid, the person signing it (the Grantor) must be of “sound mind.” They must understand:

- That they are signing a deed.

- What property is being transferred.

- Who the beneficiaries are.

- The consequences of the transfer.

If a disgruntled heir can prove that the Grantor suffered from advanced dementia, Alzheimer’s, or was heavily medicated at the time of signing, a judge can declare the deed void. Medical records from the time the deed was notarized are usually the “smoking gun” in these cases.

B. Undue Influence

“Undue influence” occurs when a third party coerces or manipulates the property owner into signing the deed against their free will.

- Scenario: An elderly widow relies on a new caregiver or a specific child for all her meals, transportation, and banking. Suddenly, she signs a Lady Bird Deed disinheriting her other children and leaving the house solely to that caregiver.

In court, this creates a suspicion of undue influence. If the influencer isolated the victim from other family members or arranged for the lawyer and the notary themselves, the deed is highly vulnerable to being overturned.

C. Fraud and Forgery

While less common, outright fraud does happen. This can involve:

- Forgery: Someone faking the Grantor’s signature.

- Fraud in the Factum: Tricking the Grantor into signing the deed by telling them it is a different document, such as a medical release form or a census survey.

D. Technical Defects (Improper Execution)

Real estate law is incredibly formal. If the strict requirements for executing a deed are not met, the document is worthless.

- Witnesses: In states like Florida, a deed must be signed in the presence of two witnesses. If the witnesses were not actually in the room, or if one of the witnesses was also the beneficiary (creating a conflict of interest), the deed can be contested.

- Notarization: If the notary did not witness the signature or if the notary’s commission had expired, the deed is invalid.

- Legal Description: If the deed lists the wrong lot number or an incomplete legal description of the property, it may fail to transfer title.

3. The Unique Vulnerability: Revocability

The defining feature of a Lady Bird Deed—the owner’s right to revoke it—is also its biggest source of conflict.

Unlike a standard Life Estate deed, a Lady Bird Deed is not irrevocable. The owner can wake up one morning, decide they are angry with the beneficiary, and sign a new deed giving the house to someone else. They can also sell the house and spend the money, leaving the beneficiary with nothing.

The Contest Scenario:

Often, a contest arises not because the original deed was bad, but because a second deed appears.

- Example: Dad signs a Lady Bird Deed leaving the house to Son. Two years later, Dad gets remarried and signs a new Lady Bird Deed leaving the house to his new Wife.

- Upon Dad’s death, Son tries to contest the second deed. He must prove that Dad lacked capacity when he signed the second deed or was unduly influenced by the new wife. If the second deed is valid, the first one is legally revoked and the Son gets nothing.

4. Spousal Rights and Homestead Laws

One of the most technical ways to contest a Lady Bird Deed involves spousal rights, particularly in Florida.

Florida has strict “Homestead” laws that prevent a married person from disinheriting their spouse. If a homeowner attempts to use a Lady Bird Deed to leave their primary residence to their children (or a friend) while they are still married, and the spouse has not signed a waiver of their rights, the deed is legally defective.

In this scenario, the surviving spouse can contest the deed. The court will typically void the transfer, and the property will pass according to state intestacy laws—often giving the spouse a “life estate” and the children the remainder, regardless of what the Lady Bird Deed said.

5. Who Has “Standing” to Contest?

You cannot contest a Lady Bird Deed just because you think it is unfair. You must have legal “standing.”

- Beneficiaries of a Prior Will: If you were set to inherit the house in a previous Will, and the Lady Bird Deed removed that inheritance, you have standing because you have suffered a financial loss.

- Legal Heirs: Children or spouses who would have inherited the property by law if the deed didn’t exist (intestate heirs) have standing.

- Creditors: This is tricky. Generally, creditors cannot contest a Lady Bird Deed after death to satisfy debts of the beneficiary immediately, but they might try to claim the transfer was a “fraudulent conveyance” if the owner signed the deed specifically to hide assets while being sued. However, one of the main perks of the Lady Bird Deed is that it usually protects the home from the Grantor’s creditors upon death (depending on state law).

6. The Litigation Process: What Happens in Court?

Contesting a deed is a civil lawsuit, usually filed in the “Chancery” or “Equity” division of the local court, or sometimes within Probate court depending on the state.

- Filing the Complaint: The challenger (Plaintiff) files a lawsuit against the beneficiary (Defendant) seeking “Declaratory Judgment” to void the deed.

- Discovery: Both sides subpoena medical records, bank statements, and emails. They will depose the lawyer who drafted the deed, the notary, and the witnesses.

- The Burden of Proof: In most civil cases, the burden is on the challenger to prove by “clear and convincing evidence” that the deed is invalid. This is a high bar. Courts generally presume that a signed, notarized legal document is valid.

- Quiet Title: If the challenger wins, the court issues an order “Quieting Title,” effectively erasing the Lady Bird Deed from the public record. The property then reverts to the previous owner’s estate and is distributed via their Will or probate laws.

7. Medicaid Estate Recovery: The State as the Contestant

One of the primary reasons people use Lady Bird Deeds is to avoid Medicaid Estate Recovery. When a person dies after receiving Medicaid benefits for nursing home care, the state usually tries to seize their assets to pay back the debt.

In many states, the government can only seize assets that pass through probate. Since a Lady Bird Deed bypasses probate, the home is usually safe.

However, states change their laws. If a state expands its definition of “estate recovery” to include non-probate assets (as some have tried), the State itself could theoretically contest the transfer or place a lien on the property. Currently, in Michigan, Texas, and Florida, Lady Bird Deeds are generally effective at stopping this, but it is an area of law that requires constant vigilance.